Many, many years ago I studied psychology and one of the most interesting courses I did was on development psychology – how we go from babies to infants to toddlers to children to teenagers to adults. The most fascinating lecture series was on Theory of Mind – the notion that, as we grow up we gradually realise that others around us have minds completely separate from our own, with completely independent thoughts (amazingly, this is only really fully developed in most people around age 11). Babies are born completely egocentric – they have no comprehension of entities other than themselves. And even 2-3 year olds are generally incapable of understanding that someone else might have a different point of view to themselves (the classic experiment shows how a 2-3 year old is rarely capable of understanding why an adult can’t see something he/she sees, even if that item is completely blocked from the adult’s view).

Anyway, the point is that there is a gradual shift from a wholly egocentric perspective (“I am everything there is the world”) to comprehending and respecting others’ independent points of view.

What has this got to do with competition and product marketing? Well I think this process (of “growing up” essentially) maps quite nicely on to how many companies grow up in their view of competitors to their products. Many startups and small companies (often in “incubators”!) are very inward-focussed. They concentrate heavily on their products and innovations and, yes, they talk to their customers, but competitors? If you’re lucky, you might see a random email asking “Has anyone tried out competitor X’s product yet?”.

As companies grow, someone might twig that “Hey, perhaps we should see what others are doing in this space!”. So perhaps some “Competitor sheets” get written and you might try out their tools, but you don’t really fear them and this still comes back to an egocentric point of view – the belief that from a customer’s point of view, you are the most important thing in the world – that they will see your products first, and only consider competitors as secondary also-rans. This is the toddler point of view – you know there are other companies out there, but you don’t see them as equals.

But what happens when you grow up? You realise you’re not the only one around. That there are competitors who sell products just like yours that might be better, faster, cheaper and, most importantly, that the customers out there have no inherent bias towards you as a vendor. There is a lot of brand loyalty out there, but this tends to be for specific products rather than a whole company (e.g. I’ll buy a Sony TV, doesn’t mean to say I’ll buy a Playstation).

And it’s dangerous to rely on the brand loyalty, particularly when you’re after new customers. The simple truth is that if someone has barely heard of you before, then that person will weigh up your offering against your competitors equally and you’d better make sure what you’re offering isn’t found wanting. Your competitor’s product is just as valid and attractive as yours.

Which is why we track competitors heavily at Red Gate. This includes things like:

- News – announcements, new versions, new functionality and so on (including trying out new features when they arrive).

- Company news – has someone just received $50m of funding for a research area you currently operate in? Worth knowing.

- Their partnerships. That small player is less easy to dismiss when they’ve just struck a partnership with IBM to distribute round the world.

- Twitter – are people talking about them? What are they saying? In what volume? NB: A lot of Twitter activity can be self-generated by publicity-hungry companies, so worth checking where it’s coming from.

- Google Alerts – this is a general measure of “web activity” but can show things like:

- Are people writing posts about them?

- Are they developing a lot of support collateral and documentation themselves?

- Is the competitor product very buggy (for example, in the tech world, many ask for answers to problems on Stack Overflow). NB: if there are a lot of questions about a competitor product this means both that it’s popular and that it might have bugginess problems – worth reading what people are asking.

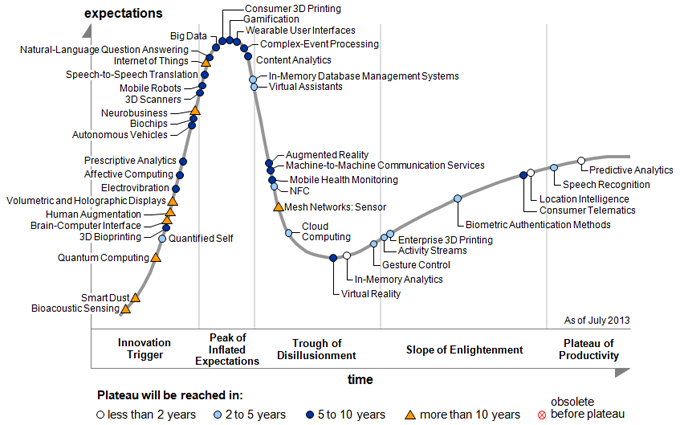

Another interesting point about keeping an eye on activity, is that it gives you a crude measure of where in the hype cycle a particular product is. Gartner produce a very interesting hype cycle each year for emerging tech (in essence, is this product/tech just hype or are people really using it):

(NB: I love the term “Trough of Disillusionment”!).

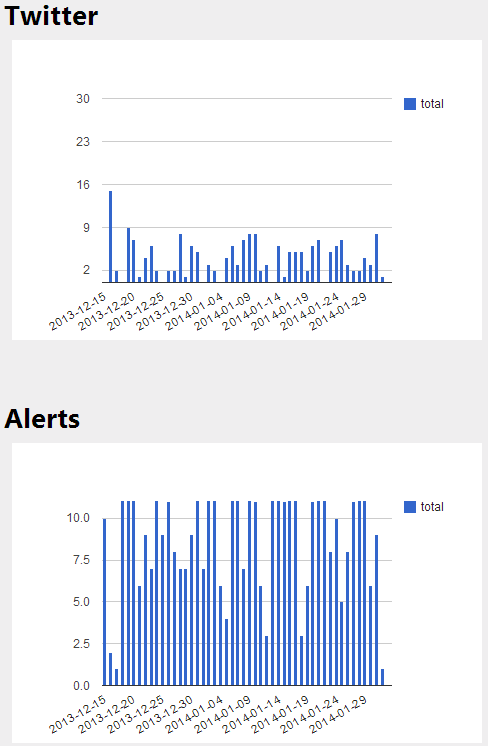

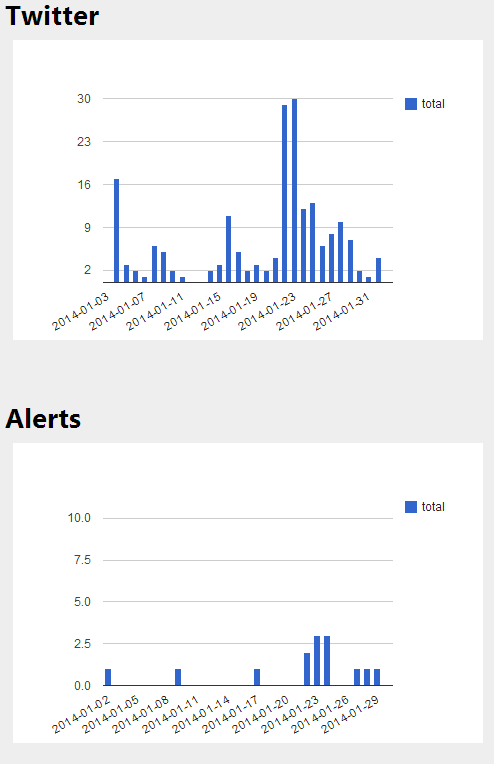

The following two (anonymised obviously) charts are for two different competitors of ours:

Competitor A

Competitor B

These charts show the number of tweets and alerts for each competitor each day.

Competitor A doesn’t get much Twitter activity – may be the early adopter hipsters aren’t tweeting about it on a daily basis. But, there are lots of alerts for the product, most of which are on Q+A sites, users asking questions about “How do I configure X?”, “How does Y work?”.

Competitor B isn’t doing so bad on Twitter. A steady stream of activity, particularly over the last few weeks. But, for alerts, it’s all very quiet. And, if you look at what the actual tweets are, most of those come from the vendor themselves.

So for competitor A, this is likely to be a product late in the hype cycle – i.e. people are actually starting to use it! Competitor B – it’s all still hype. I’m more afraid of competitor A than competitor B..

Anyway, we as an organisation have grown up and take a lot more notice of the competition nowadays – and we don’t assume a customer will always buy from us instead of them (despite us being better ? ). Would you say the same?